The Newscaster/Nature Coast News

PAGE 11 - January 28, 2015

"Searching for the Truth"

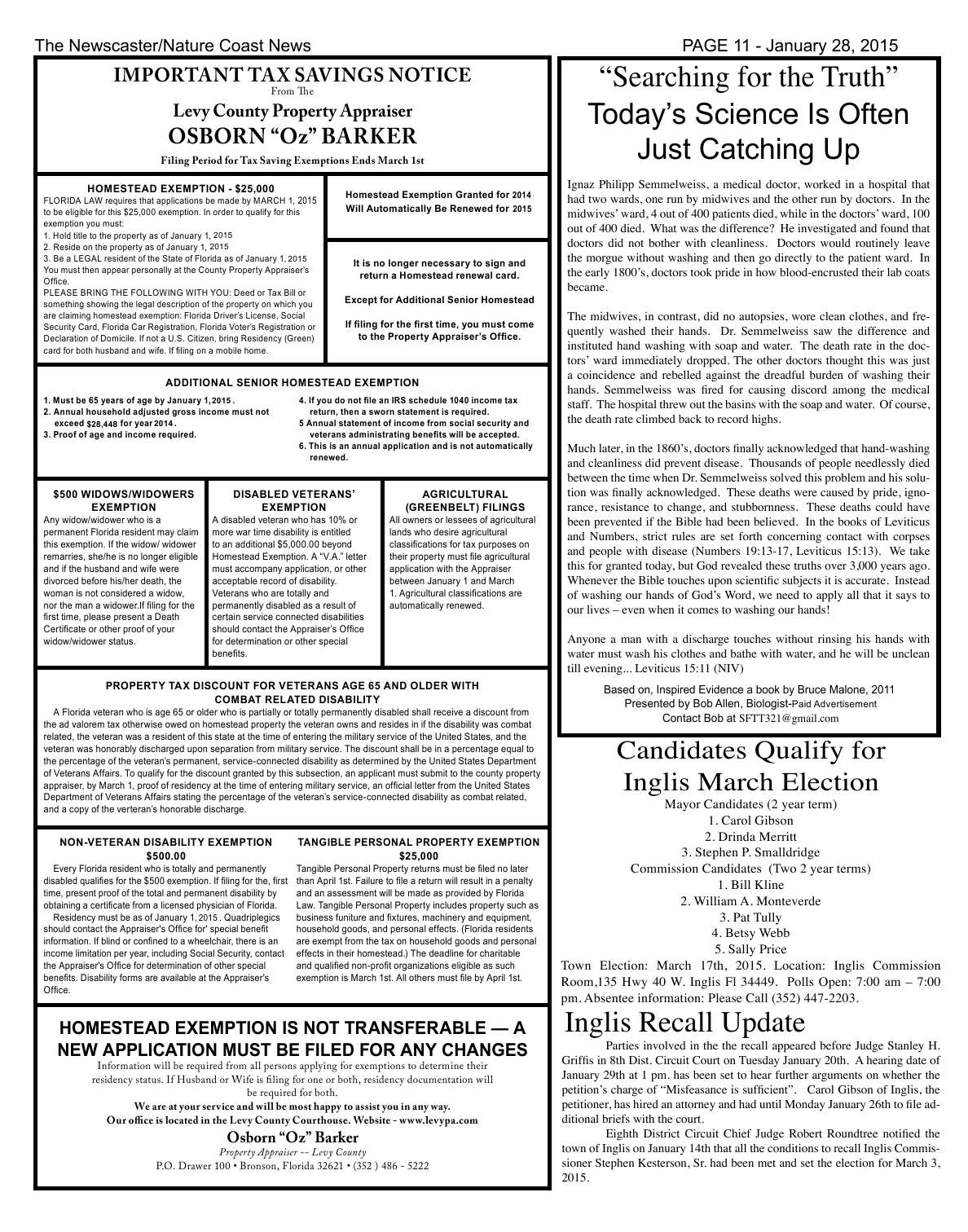

IMPORTANT TAX SAVINGS NOTICE

From The

Today's Science Is Often

Levy County Property Appraiser

OSBORN "Oz" BARKER

Just Catching Up

Filing Period for Tax Saving Exemptions Ends March 1st

Ignaz Philipp Semmelweiss, a medical doctor, worked in a hospital that

HOMESTEAD EXEMPTION - $25,000

had two wards, one run by midwives and the other run by doctors. In the

Homestead Exemption Granted for 2014

2013

2015

FLORIDA LAW requires that applications be made by MARCH 1, 2014

Will Automatically Be Renewed for 2014

midwives' ward, 4 out of 400 patients died, while in the doctors' ward, 100

2015

to be eligible for this $25,000 exemption. In order to qualify for this

out of 400 died. What was the difference? He investigated and found that

exemption you must:

1. Hold title to the property as of January 1, 2015

2014

doctors did not bother with cleanliness. Doctors would routinely leave

2. Reside on the property as of January 1, 2014

2015

the morgue without washing and then go directly to the patient ward. In

3. Be a LEGAL resident of the State of Florida as of January 1, 2015

2014

It is no longer necessary to sign and

the early 1800's, doctors took pride in how blood-encrusted their lab coats

You must then appear personally at the County Property Appraiser s

return a Homestead renewal card.

Office.

became.

PLEASE BRING THE FOLLOWING WITH YOU: Deed or Tax Bill or

Except for Additional Senior Homestead

something showing the legal description of the property on which you

The midwives, in contrast, did no autopsies, wore clean clothes, and fre-

are claiming homestead exemption: Florida Driver s License, Social

If filing for the first time, you must come

quently washed their hands. Dr. Semmelweiss saw the difference and

Security Card, Florida Car Registration, Florida Voter s Registration or

to the Property Appraiser s Office.

Declaration of Domicile. If not a U.S. Citizen, bring Residency (Green)

instituted hand washing with soap and water. The death rate in the doc-

card for both husband and wife. If filing on a mobile home.

tors' ward immediately dropped. The other doctors thought this was just

a coincidence and rebelled against the dreadful burden of washing their

ADDITIONAL SENIOR HOMESTEAD EXEMPTION

hands. Semmelweiss was fired for causing discord among the medical

staff. The hospital threw out the basins with the soap and water. Of course,

1. Must be 65 years of age by January 1, 2015

2014.

4. If you do not file an IRS schedule 1040 income tax

2. Annual household adjusted gross income must not

return, then a sworn statement is required.

the death rate climbed back to record highs.

exceed $28,448 for year 2014

$27,994

2013.

5 Annual statement of income from social security and

3. Proof of age and income required.

veterans administrating benefits will be accepted.

Much later, in the 1860's, doctors finally acknowledged that hand-washing

6. This is an annual application and is not automatically

renewed.

and cleanliness did prevent disease. Thousands of people needlessly died

between the time when Dr. Semmelweiss solved this problem and his solu-

tion was finally acknowledged. These deaths were caused by pride, igno-

$500 WIDOWS/WIDOWERS

DISABLED VETERANS

AGRICULTURAL

rance, resistance to change, and stubbornness. These deaths could have

EXEMPTION

EXEMPTION

(GREENBELT) FILINGS

been prevented if the Bible had been believed. In the books of Leviticus

Any widow/widower who is a

A disabled veteran who has 10% or

All owners or lessees of agricultural

and Numbers, strict rules are set forth concerning contact with corpses

permanent Florida resident may claim

more war time disability is entitled

lands who desire agricultural

this exemption. If the widow/ widower

to an additional $5,000.00 beyond

classifications for tax purposes on

and people with disease (Numbers 19:13-17, Leviticus 15:13). We take

remarries, she/he is no longer eligible

Homestead Exemption. A "V.A." letter

their property must file agricultural

this for granted today, but God revealed these truths over 3,000 years ago.

and if the husband and wife were

must accompany application, or other

application with the Appraiser

Whenever the Bible touches upon scientific subjects it is accurate. Instead

divorced before his/her death, the

acceptable record of disability.

between January 1 and March

of washing our hands of God's Word, we need to apply all that it says to

woman is not considered a widow,

Veterans who are totally and

1. Agricultural classifications are

nor the man a widower.If filing for the

permanently disabled as a result of

automatically renewed.

our lives even when it comes to washing our hands!

first time, please present a Death

certain service connected disabilities

Certificate or other proof of your

should contact the Appraiser s Office

Anyone a man with a discharge touches without rinsing his hands with

widow/widower status.

for determination or other special

water must wash his clothes and bathe with water, and he will be unclean

benefits.

till evening... Leviticus 15:11 (NIV)

PROPERTY TAX DISCOUNT FOR VETERANS AGE 65 AND OLDER WITH

Based on, Inspired Evidence a book by Bruce Malone, 2011

COMBAT RELATED DISABILITY

Presented by Bob Allen, Biologist-Paid Advertisement

A Florida veteran who is age 65 or older who is partially or totally permanently disabled shall receive a discount from

Contact Bob at SFTT321@gmail.com

the ad valorem tax otherwise owed on homestead property the veteran owns and resides in if the disability was combat

Candidates Qualify for

related, the veteran was a resident of this state at the time of entering the military service of the United States, and the

veteran was honorably discharged upon separation from military service. The discount shall be in a percentage equal to

the percentage of the veteran s permanent, service-connected disability as determined by the United States Department

Inglis March Election

of Veterans Affairs. To qualify for the discount granted by this subsection, an applicant must submit to the county property

appraiser, by March 1, proof of residency at the time of entering military service, an official letter from the United States

Department of Veterans Affairs stating the percentage of the veteran s service-connected disability as combat related,

Mayor Candidates (2 year term)

and a copy of the verteran s honorable discharge.

1. Carol Gibson

2. Drinda Merritt

NON-VETERAN DISABILITY EXEMPTION

TANGIBLE PERSONAL PROPERTY EXEMPTION

3. Stephen P. Smalldridge

$500.00

$25,000

Commission Candidates (Two 2 year terms)

Every Florida resident who is totally and permanently

Tangible Personal Property returns must be filed no later

1. Bill Kline

disabled qualifies for the $500 exemption. If filing for the, first

than April 1st. Failure to file a return will result in a penalty

time, present proof of the total and permanent disability by

and an assessment will be made as provided by Florida

2. William A. Monteverde

obtaining a certificate from a licensed physician of Florida.

Law. Tangible Personal Property includes property such as

3. Pat Tully

Residency must be as of January 1, 2015 Quadriplegics

2013.

business funiture and fixtures, machinery and equipment,

4

4. Betsy Webb

should contact the Appraiser's Office for' special benefit

household goods, and personal effects. (Florida residents

information. If blind or confined to a wheelchair, there is an

are exempt from the tax on household goods and personal

5. Sally Price

income limitation per year, including Social Security, contact

effects in their homestead.) The deadline for charitable

Town Election: March 17th, 2015. Location: Inglis Commission

the Appraiser's Office for determination of other special

and qualified non-profit organizations eligible as such

Room,135 Hwy 40 W. Inglis Fl 34449. Polls Open: 7:00 am 7:00

benefits. Disability forms are available at the Appraiser's

exemption is March 1st. All others must file by April 1st.

Office.

pm. Absentee information: Please Call (352) 447-2203.

Inglis Recall Update

HOMESTEAD EXEMPTION IS NOT TRANSFERABLE -- A

Parties involved in the the recall appeared before Judge Stanley H.

NEW APPLICATION MUST BE FILED FOR ANY CHANGES

Griffis in 8th Dist. Circuit Court on Tuesday January 20th. A hearing date of

Information will be required from all persons applying for exemptions to determine their

January 29th at 1 pm. has been set to hear further arguments on whether the

residency status. If Husband or Wife is filing for one or both, residency documentation will

petition's charge of "Misfeasance is sufficient". Carol Gibson of Inglis, the

be required for both.

petitioner, has hired an attorney and had until Monday January 26th to file ad-

We are at your service and will be most happy to assist you in any way.

ditional briefs with the court.

Our office is located in the Levy County Courthouse. Website - www.levypa.com

Eighth District Circuit Chief Judge Robert Roundtree notified the

Osborn "Oz" Barker

town of Inglis on January 14th that all the conditions to recall Inglis Commis-

Property Appraiser -- Levy County

sioner Stephen Kesterson, Sr. had been met and set the election for March 3,

P.O. Drawer 100 · Bronson, Florida 32621 · (352 ) 486 - 5222

2015.